You have probably heard a lot of information about stamp duty in 2020 and want to know how stamp duty is charged on your UK property investment. Our overview should help give you some more clarity.

Overview.

The UK property tax has been a big topic of recent conversation from home buyers and property investors alike. We’ll explain in more detail in this article the changes that were made in 2020 and how they specifically affect you whether you’re a first time home buyer, or this is your second property etc.

But what are the main things you need to know if you’re a property investor? How is stamp duty for investment property calculated? Here are some of the main things you need to know.

(Please note: Select Property Group is not a tax advisor. Please use this article as a guide only and contact your financial advisor for further support).

1. What is stamp duty?

Stamp duty, or stamp duty land tax (SDLT) to give its full title, is a tax that’s applicable for any residential property purchase or investment in England and Northern Ireland.

It is payable upon completion of the purchase. For off-plan properties, SDLT is paid upon completion of the building.

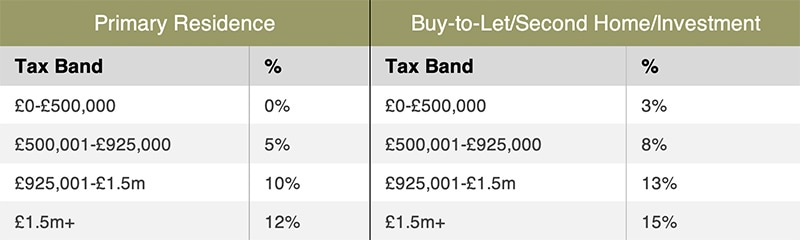

However, the taxable amounts vary depending on whether you’re buying a property that will be your primary UK residence, whether it’s a second home or investment, or if you are a non-UK resident.

2. Differences by UK nation.

It’s important to note that SDLT is only applicable to properties in England and Northern Ireland.

Both Scotland and Wales have their own equivalents of the tax. In Scotland, it’s Land and Buildings Transaction Tax (LBTT), while in Wales it’s Land Transaction Tax (LTT).

All three taxes are applied differently and are calculated in different ways.

In this article, we are discussing SDLT on residential property in England and Northern Ireland.

3. What is the stamp duty holiday?

In July 2020, UK Chancellor of the Exchequer, Rishi Sunak, announced a stamp duty holiday for property buyers in England and Northern Ireland.

Valid until 31st March 2021, anyone purchasing a property to be used as their primary residence will not pay any SDLT if the property is valued below £500,000.

The move was designed to drive activity and increase buyer confidence in the UK property market following the three-month national lockdown in the second quarter of 2020.

However, it’s important to note that despite the stamp duty holiday, different rates are applied for non-resident buyers or those buying a property for investment purposes.

SDLT Holiday Rates in England & Northern Ireland – Valid Until 31st March 2021.

Example calculations based on a property valued at £640,000.

Own home:

- 0% on the first £500,000

- A remainder of £140,000 of the property’s value falls into the second SDLT band, levied at 5%

- 5% of £140,000 = £7,000 total SDLT payable

Second home/investment property:

- 3% on the first £500,000 = £15,000

- A remainder of £140,000 of the property’s value falls into the second SDLT band, levied at 8%

- 8% of £140,000 = £11,200

- £26,200 total SDLT payable

4. How to calculate stamp duty from 2021.

From 1st April 2021, the previous rates of SDLT that were in place prior to the stamp duty holiday will be reintroduced.

As above, those buying a property to use for their own primary residence will be subject to a separate set of SDLT rates from those purchasing a property for investment purposes.

But there will also be a new additional rate of SDLT that non-UK residents will need to pay when investing in property. The new additional 2% surcharge on investments made by non-UK residents will apply to all property purchased in England and Northern Ireland from 1st April.