UK property has long been considered one of the world’s most trusted investment assets. A dynamic market accelerated by the pandemic, house prices increased by 20.4% over the last three years, compared to growth of just 7.8% across the three years previous.

Although London has a population of 9 million and accounts for almost a quarter of the UK’s total economic activity, many buyers have turned to other regional cities to achieve the highest possible growth from UK property investment.

While the capital was once a lucrative option for property investors, its affordability ceiling means that value for money and rental yields are not what they once were. This has led many investors to the ‘Capital of the North’, Manchester, with average rental yields almost double that of London.

London vs. Manchester

| Location | Average property price | Average rental yield |

| Central London (W1, WC & EC postcode) | £1,461,598 | 2.9% |

| Manchester (M1 postcode) | £277,570 | 5.4% |

Source: Rightmove; Property Data, July 2023.

For prime developments in Manchester with high demand amenities, this yield percentage rises even higher. Select Property’s most iconic Manchester development to date, One Port Street, boasts an M1 postcode, a rooftop garden, a luxury swimming pool and a 360 firepit lobby. Take the virtual tour here.

This same budget (starting at £325,000) could get you an apartment in E3 London – an hour drive from Central London. Typically a 1980s apartment with no amenity or concierge, this type of property often requires regular maintenance – not ideal for hands-off investors looking for a hassle-free investment. Understand if price per square foot is important when it comes to investment property.

Comparing rental markets

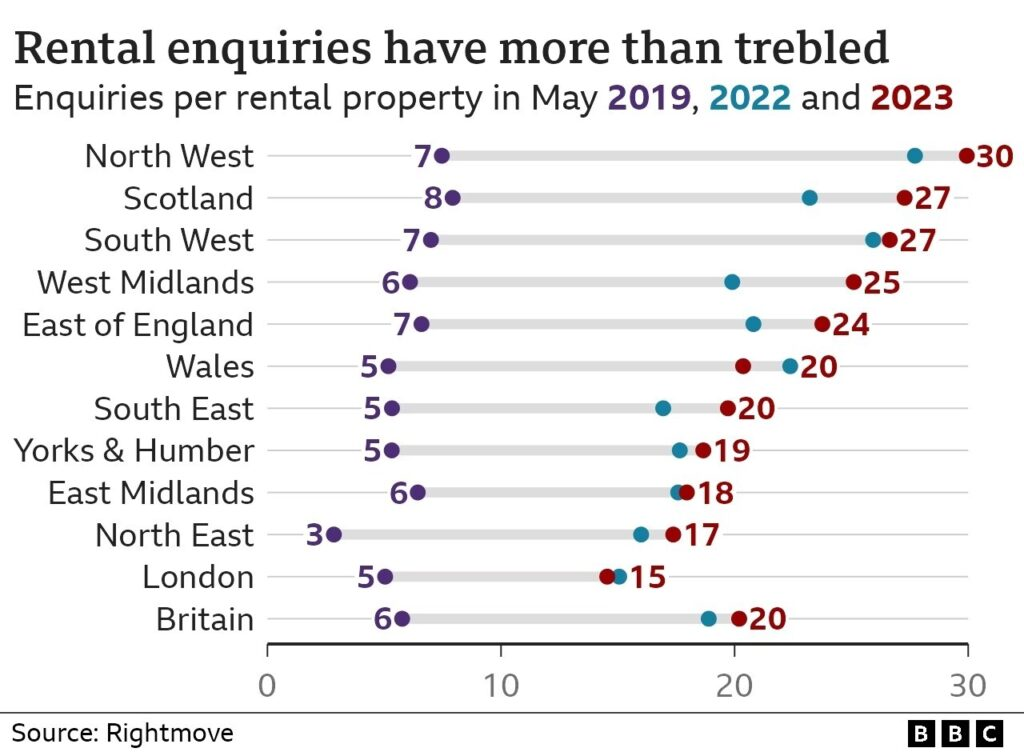

Rightmove recently reported that rental enquiries have more than tripled since May 2019.

The North West (Manchester’s region) is seeing the highest number of rental enquiries, going from an average of just 7 per property in 2019, to 30 in 2023.

Seeing the lowest increase is England’s capital, London, demonstrating the growing ‘North-shoring’ trend of people leaving the capital to live in regional cities that offer more amenities and lower rent.

Why invest in Manchester?

According to JLL, Manchester is leading the 5-year rental growth forecasts in the UK with projected growth of 21.6%. On top of this, according to the city’s 5-year sales forecast, the value of your property would appreciate by 19.3% by 2027.

Manchester Fast Facts

- Region: North West

- Population: 2.8 million

- Distance from London: 200 miles/2-hour direct train link (1-hour, 11 minutes with HS2)

Manchester’s average annual gross value added (GVA) is projected to grow at a rate of 2.5% between 2024 and 2026. The national UK rate of growth is 2.1%, with Manchester the third-fastest growing city (after Reading and London).

Recent research by the Northern Powerhouse Partnership revealed that between 2004 and 2020, economic growth in Greater Manchester significantly exceeded the rate of growth achieved in every other UK city region, including London. The engine of that economic growth was Manchester city centre.

What is attracting renters to Manchester?

Manchester’s population is rising at a rate of twice the national average, heralding an increasing need for rental property in the city. But what is attracting people to live in Manchester?

- Strong job market – 80 out of 100 FTSE Top 100 companies have a presence in Manchester, attracting an ever-growing pool of young professionals. Other global companies include Deloitte, Deliveroo, Uber, Kellogg’s, BBC and Siemens.

- Plans are in place to build a further 2.6 million square feet of office space for Manchester’s growing talent pool

- High graduate retention rate from the city’s five universities, one of which is Russell Group, The University of Manchester. The city has the UK’s largest international student population outside of London

- The city’s position as a transport hub – with three train stations, a major international airport and multiple road links – makes it an ideal location for professionals and commuters. This will only improve with the implementation of HS2

- North-shoring trend of renters leaving London in search of better amenities, more affordable rent and a shorter commute.

- Manchester’s vibrant food, drink, arts & culture scene is attracting global attention, with recent openings of Manchester Museum, world-class arts venue Factory International, food & creative destination Diecast, and the highly anticipated Soho House Manchester.

Find out more about what’s attracting so many people to Manchester in our podcast with Thom Hetherington – Food, Drink, Arts & Culture entrepreneur.

To find out more about investing in One Port Street, Manchester, contact us and we’ll be in touch with our latest payment plan. Already 75% sold since global launch in February 2023.